This is Part 2 in the Cook County Election Security Interview

Last week, I sat down with Cook County Clerk Karen Yarbrough and her Deputy, John Mirkovic to discuss the many cyber security changes. Clerk Yarbrough gave an excellent interview discussing changes she has helped bring about during her tenure to protect the ballot box. As a followup to that interview, I sat down with her Deputy who provided more technical details regarding the current state of cyber security readiness and efforts to adopt leading technologies to streamline and secure government from cyber attacks. To view, Part 1 Please watch this followup to the previous interview with Clerk Yarbrough by clicking the image below.

The transcript of the interview follows:

Election Cyber Security Safeguards

Lee Neubecker: Hi, I’m here today with Karen Yarbrough, the Cook County Clerk and Recorder, her deputy, John Mirkovic is her data wizard. He’s come on my show to talk a little bit about Election Cyber Security and some other interesting topics. John, thanks for coming on today.

John Mirkovic: Thanks for having us, Lee.

Lee Neubecker: So, the Clerk and I were talking a little bit about Microsoft’s open ElectionGuard and I wanted to get your take on what’s happening with that. If you could tell everyone what the platform’s about and what brought this about in terms of Microsoft’s involvement.

John Mirkovic: Yeah, we’re pretty excited about this and one reason, our vendor is participating. So, generally, this is an idea to build really the best voting machine out there or kind of establish the software and hardware standards that the government would like jurisdictions across the country to adopt to really open-source standards. So, what this is about is, as you know open-source, it’s about doing all the work on the front end, publishing your code and your set-ups and inviting the world to attack it and try and penetrate it. So, our vendor is working with this system. We are monitoring the progress. It’s moving a little slow but we’re excited that there are finally people talking about open-source in government because it’s really the most important.

Lee Neubecker: Oh yeah, and it’s good too because essentially you’re putting the spotlight on the system. So, if there’s a bug, everyone’s talking about it online and it gets fixed, it’s transparent and what I like the best about this is it creates a potential for all these Clerks and other parties responsible for voting to be able to capture and preserve those votes and introduce technology to allow people to verify that their vote was cast as intended.

John Mirkovic: Yeah, exactly, and a lot of offices across the country don’t have enough resources to get the equipment they want. There are a lot of states that vote only on electronic machines which is frightening, really, and it’s kind of the worst system to have, so, any kind of sharing of resources is vital for the government to be able to quickly get the entire country up to the same standard.

Lee Neubecker: So, John has the federal government been helping get Cook County ready for the next election cycle? And if so, what has the federal government’s role been with assisting you?

John Mirkovic: Yeah, they’ve been a great partner both Department of Homeland Security and the FBI. It is a true partnership because we have adequate resources here, so we’re able to implement a lot of the cutting edge stuff that they would like to see across the country.

John Mirkovic: So, we are almost like a pilot or a laboratory really. They’re in our office on Election Day, monitoring the systems, checking how all the CyberSecurity systems work, and real-time threat sharing. So, yeah, we in Cook County are considered to be amongst the top 1% of performers in the country and we’re happy to help spread that information to other jurisdictions.

Lee Neubecker: Last time when you and I had lunch, you were telling me a little bit about some of your work in the blockchain space and some of your ideas for how you thought blockchain might be able to help Recorder officers everywhere with using blockchain technology to record deeds. Can you tell a little bit about what the premise is behind that and explain to people how that can revolutionize the recording of deeds?

John Mirkovic: Yeah, yeah, it sort of ties into elections too. You know the most famous blockchain out there is Bitcoin. And Bitcoin works so well because it’s only designed to do one thing which is transfer numbers from one ledger to another. So, really being inspired, you know, not only by the technological ability to protect that using hashing algorithms and digital signatures, just the general idea on architecture software in the same manner.

John Mirkovic: And, you know, Clerk Yarbrough said before, “It’s like …Back to the Future.”

John Mirkovic: Technology doesn’t always have to be about adding more features. And generally, when you build products in committees or groups, no one’s happy and the compromise is never what anyone wants. So, in election security there can be no compromises, we have to have the best.

John Mirkovic: So, blockchain, you know, is a way to digitally guarantee certain outcomes. So, you know, it’s not quite ready for elections yet though there have been some experiments with it. It’s a great technology for Land records and preferably only if it is applied on a large scale to protect the entire transaction. So, blockchain is a way to wrap an expensive, important transaction in CyberSecurity and ensure that it works out.

Lee Neubecker: So, right now, I know it’s common if people are trying to research property records. They’ll come down to the Recorder’s office, go into the basement, sometimes look through microfiche or something. Is there a likelihood that if this technology gets adopted, universally.. that all those old records will be retroactively kind of put back out onto the blockchain so that they exist in cyberspace?

John Mirkovic: Yeah, that’s a great question, one that we get a lot. It some smaller counties you would probably be able to do that. Cook County, unfortunately, has way too many records in various states of microfilm. And, to get those on, they would actually require the same types of effort that creates bad data in the first place which is re-keying data entry. So, really the best approach, if we were to switch to such a system would be… like the County used to insure title for certain transactions. So, in those cases we could, look at the transaction, insure over any risks from the 1950s and 60s. We know what else is out there, you know, the 50s in kind of electronic format. So, it’s too tough to get it all into the same system but when you think about how these systems work, you know, if you have a legacy database and a distributed database, it’s all feeding to one website, right. So, the public, you know, when they go and do their research, they’re not really going to see the background whether it’s a distributed database or a centralized database. So, it’s all about how you deliver the information to the people.

Lee Neubecker: Well, thanks a bunch for being on the show. I really appreciate it. Thank you.

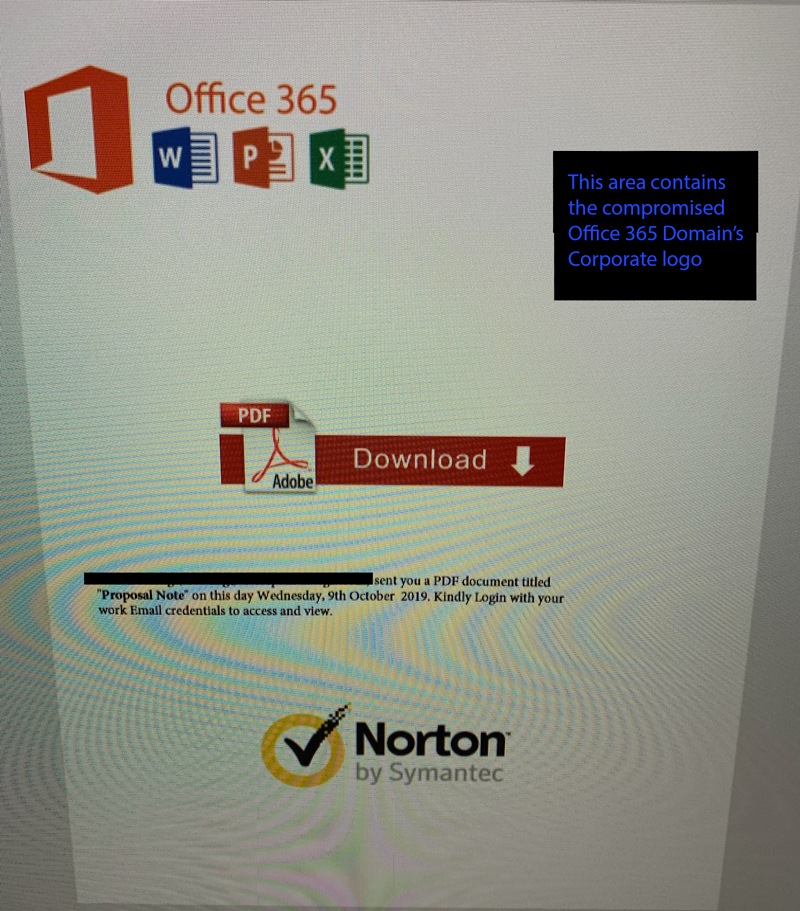

We have observed both the original inbound attachment and the outbound attachment that gets sent onward to the compromised user’s address book. Thus far, only users of Office 365 appear to be targeted. It appears that the malware checks the compromised user’s contacts and performs an mx record query to determine which contacts in the compromised user’s contact address book are hosting their email with Microsoft.

We have observed both the original inbound attachment and the outbound attachment that gets sent onward to the compromised user’s address book. Thus far, only users of Office 365 appear to be targeted. It appears that the malware checks the compromised user’s contacts and performs an mx record query to determine which contacts in the compromised user’s contact address book are hosting their email with Microsoft.